Student housing was among the fastest-growing real-estate segments in the U.K. in 2022. Rising student numbers, coupled with a shortage of beds, drove the sector’s activity in a year when the major property sectors all reported a slowdown in both deal volume and investment return. During the pandemic, a drop in physical lectures and falling international student numbers meant many institutions had to refund rents and pay for empty rooms. The experience increased universities’ risk sensitivities and created an opportunity for investors that happens to correspond with an expected U.K. shortfall of about 29,000 purpose-built student beds.

Institutional capital drove deal volume to a new high

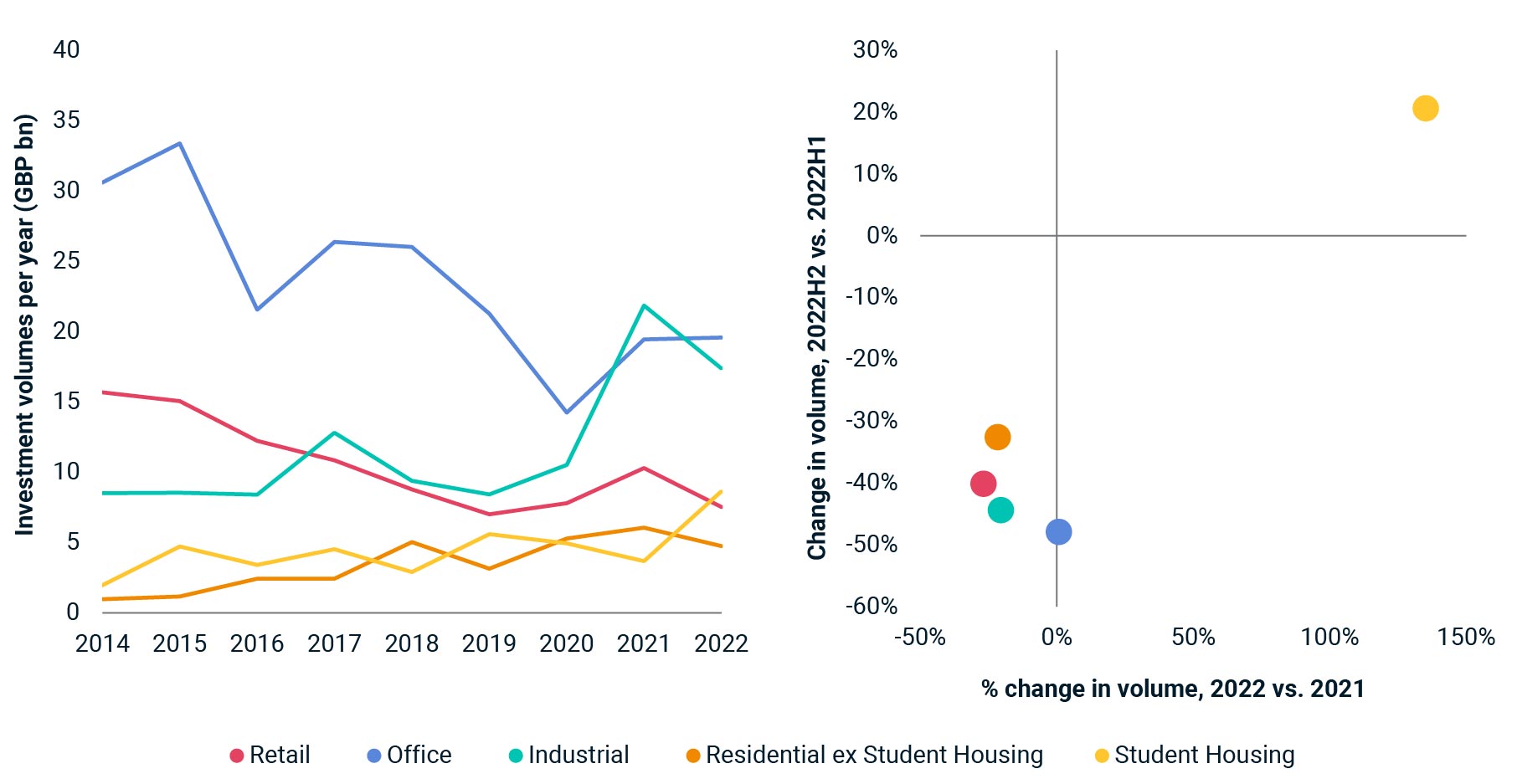

Student-housing investment activity briefly stumbled in 2020, as did most property types, as the initial impact of the pandemic filtered through the economy. In December 2019, the segment’s trailing 12-month transactions reached a new high just shy of GBP 6 billion, before falling to a five-year low of GBP 2.5 billion by June 2021. By December 2022, however, student-housing transaction volumes not only rebounded from the lows of 2020, but outpaced 2019 levels to reach a new annual high of GBP 8.7 billion. The new peak exceeded retail deal volume for the first time since the aggregation of robust deal-volume data in the U.K.

Unlike the major property sectors, student-housing transaction volumes were up in 2022 compared to 2021, accelerating as the year progressed, up more than 20% in the second half than in the first half. The GBP 3.3 billion acquisition of Brookfield Asset Management Ltd.’s student-accommodation business by GIC and Greystar Real Estate Partners LLC significantly boosted 2022 volume. The purchase was the segment’s largest U.K. deal since Blackstone Inc.’s 2020 acquisition of student-housing firm IQ in a deal worth GBP 4.7 billion.

UK student-housing deal volume grew 1.3 times in 2022 to exceed retail for first time

Source: MSCI Real Assets

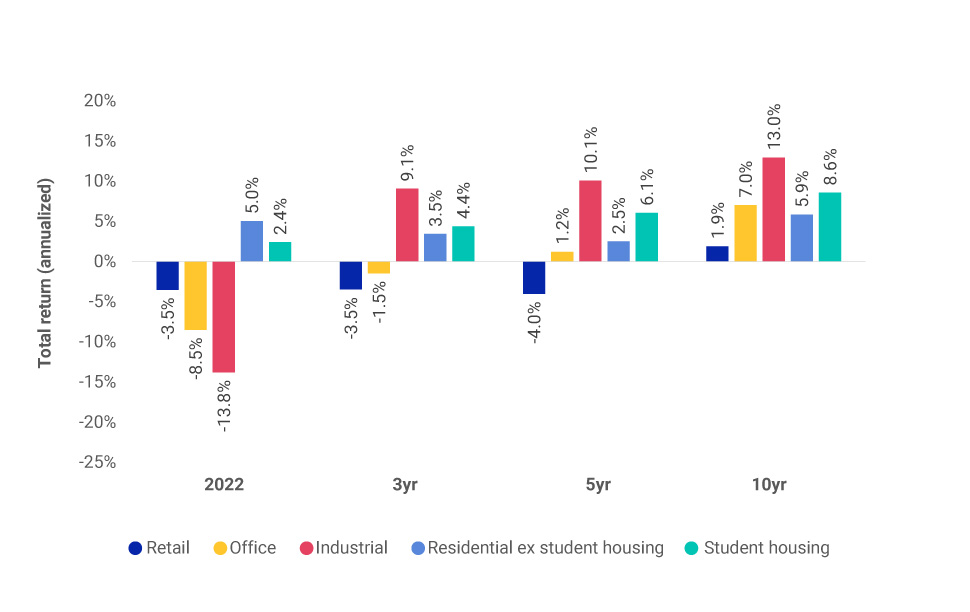

The momentum created by the increasing deal volume in the student-housing sector since 2010 has benefited its investment performance. Student housing outperformed the rest of the U.K. residential sector on an annualized basis over the three, five and 10 years ending December 2022. The segment also outperformed the retail and office sectors over the same time horizons, according to the MSCI UK Annual Property Index. In 2022, the segment posted a total return of 2.4%, outperforming the industrial sector in the face of a slowing economy and rising interest rates.

Student-housing returns held firm in 2022 and, longer term, lagged only the industrial sector

The analysis period ends December 2022. Source: MSCI Real Assets

The positive return impact of the Russell effect

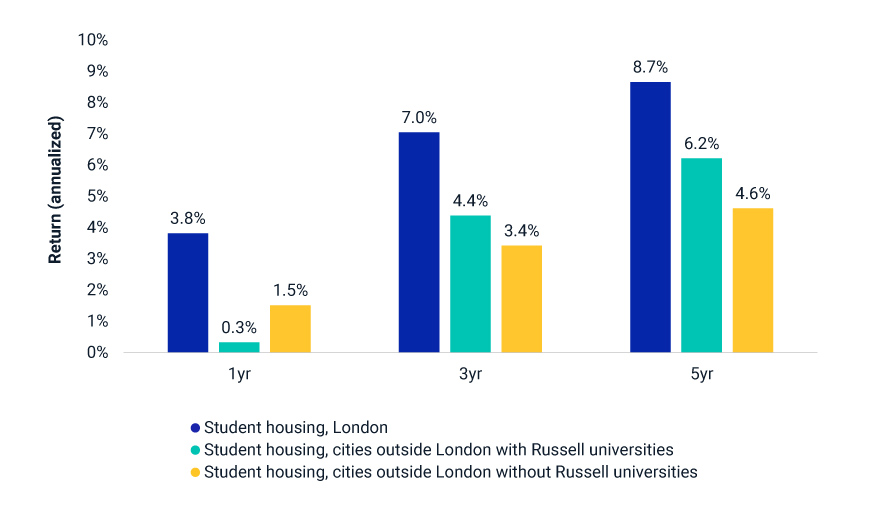

London is home to more universities and students than any other city in the U.K., with over 30 universities and colleges, including five Russell Group universities (a group of 24 public research universities in the U.K.). The city’s importance in the asset class is also reflected in the MSCI UK Annual Property Index, where it accounts for more than 30% of the U.K. student-housing market by capital value.

Since the 2015-2016 academic year, the number of students in London has grown by 70 basis points (bps) per year faster than the rest of the U.K. In the 2020-2021 academic year, 370,000 full-time higher-education students were studying in London, around four times the number of dedicated student-housing beds available. The city’s high and growing demand for student housing drove the segment’s total return to outperform other U.K. cities, both those with and without Russell Group universities, over the last one, three and five years ending December 2022.

Although London leads in student numbers, it accounts for only 18% of the U.K. student population. Student housing in cities with a Russell Group university outperformed those without by an annualized 100 bps over three years and 160 bps over five years. Student-housing assets in cities with Russell Group universities had a lower equivalent-yield impact relative to non-Russell-Group cities over the five years ending December 2022. Interestingly, the lower yield impact was more than offset by strong growth in market rentals as demand outweighed supply.

London outperformed, followed by cities with a Russell Group university

The analysis period ends December 2022. Source: MSCI Real Assets

Slicing through the return distribution yields insights

Total returns in the student-housing sector by decile ranged from 18.2% at the 90th percentile to -17.3% at the 10thpercentile in 2022. In the bottom half of the distribution, rising bond yields negatively impacted properties’ net-operating-income (NOI) yields, putting pressure on capital growth. In contrast, assets in the top half of the distribution benefited from positive income growth, which offset any negative yield impact.

Analyzing total return by decile revealed that assets in the lowest decile (a total return of -10.3% or worse) started with the lowest NOI yields and weakened further to record a negative yield impact for the year. At year-end, the NOI yields of the lowest-decile properties were in line with the segment average, suggesting that some assets may have been priced too high in prior years, notwithstanding their positive income growth.

Meanwhile, top-decile properties experienced minimal yield impact and were able to expand their NOI. Assets in the middle of the total-return distribution sported healthy occupancy rates and positive net-income growth, but those positives were tempered by a negative yield impact as yields adjusted to a higher risk-free rate.

No yield movement for student housing’s 2022 top-decile performers

The net-operating-income (NOI) yield was measured over calendar-year 2022. The NOI yield is as of Dec. 31, 2022. Source: MSCI Real Assets

The student-housing sector hit its stride in 2022

A widening supply/demand imbalance propelled student housing to a new high in annual deal volume and continued to attract the attention of institutional investors. The segment outperformed the office, retail and other residential sectors over the last three, five and 10 years, and outperformed the industrial sector in 2022. As the segment continues to evolve as a distinct asset type within the U.K. residential sector, investors may benefit from a more detailed segmentation when benchmarking the performance of their funds and assets.

Discussion about this post